Key Points

-

Housing demand in Australia is rising quickly because of a surge in net overseas migration. However, housing supply is not lifting in line with demand because of high interest rates and issues in the residential construction industry. This is causing a housing shortage in Australia.

-

The housing shortage is putting upward pressure on rents, which are already high. Rental vacancy rates are at a record low. Home prices are also starting to rise again and the housing shortage is helping to lift prices.

-

If Australia keeps running high immigration targets, then the government has an important role to play in helping to increase housing development, build affordable homes, and target infrastructure outside of the capital cities.

Introduction

Australia is not building enough homes for its population, predominantly because overseas migration has risen back to record highs at a time that residential construction is slowing. This housing supply problem will add further strain to an already tight rental market and provide upside support to home prices (all other things being equal). We look at the housing supply problem in this Econosights.

Housing demand versus supply

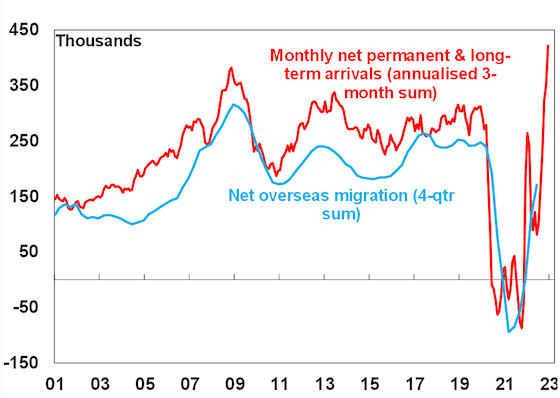

Demand and supply play an important role in the price of housing, either in the purchasing or the rental market. Housing demand is determined by population growth (mostly driven by net overseas migration) and changes to household size. In Australia, the average number of people per household has declined from 2.9 persons in 1983 to a little below 2.5 persons in 2022. Housing supply is determined by construction levels (after taking into account demolitions, conversions and vacant properties). New housing demand fell significantly in 2020 as net migration ground to a halt but this will be more than reversed in coming years as demand is due to surge again from the inflow of permanent migrants (see the chart below).

Australian net immigration on the rise again

Source: ABS, Macrobond, AMP

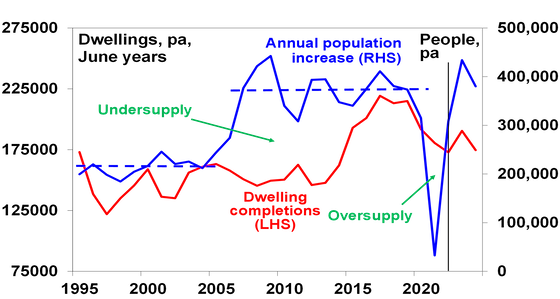

As a result, housing supply will need to lift significantly in Australia to respond to high population growth. But, residential construction is in a downturn because of the rise in interest rates since May 2022 (the cash rate has increased by 350 basis points so far or 3.50%) and the subsequent hit to borrowing capacity and household excess cash flow and the end of the Governments HomeBuilder grant. Building approvals are currently more than 30% lower compared to a year ago which will flow through into lower housing completions over 2023. As a result, population growth is expected to run well above completions over the next few years (see the chart below) leading to housing undersupply.

Home construction versus population growth

Source: ABS, Macrobond, AMP

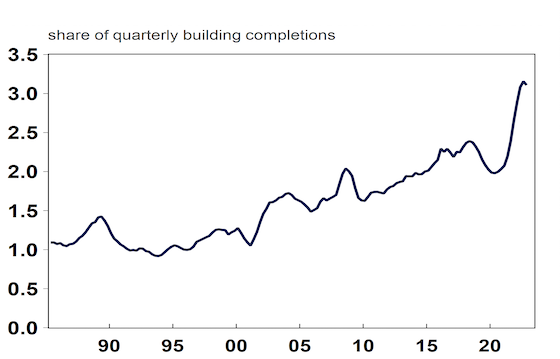

Recent estimates from the National Housing Finance and Investment Corporation estimate that housing shortage will be worth 100,000 dwellings over the next 5 years. Residential construction is also being impacted by construction firms going out of business, ongoing supply chain problems in obtaining materials, an ultra-tight labour market and an increase in borrowing costs and lending standards. These issues have resulted in a larger-than-usual pipeline of residential work that is yet-to-be-done. The chart below shows that there is currently around 9 months worth of construction work that is yet to be done – a record high. The risk is that problems in the construction sector see this pipeline of activity not fully translated into actual completions.

Australia Residential Construction Yet To Be Done

Source: Macrobond, AMP

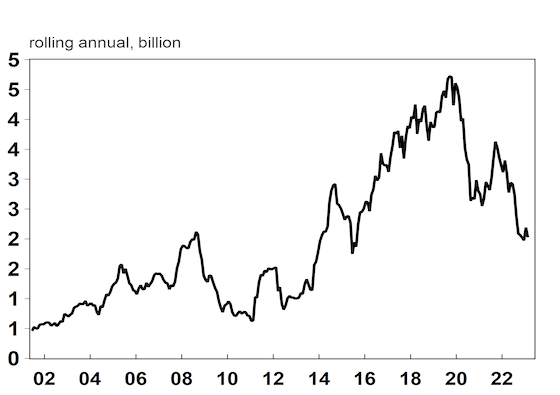

Construction of short-term accommodation could help to alleviate housing shortages but building approvals for short-term accommodation have been trending down since late 2021 and on a 12-month basis are at their lowest levels since 2016 (see the chart below).

Short-term accomodation building approvals

Source: Macrobond, AMP Australia

Impacts of the housing shortage

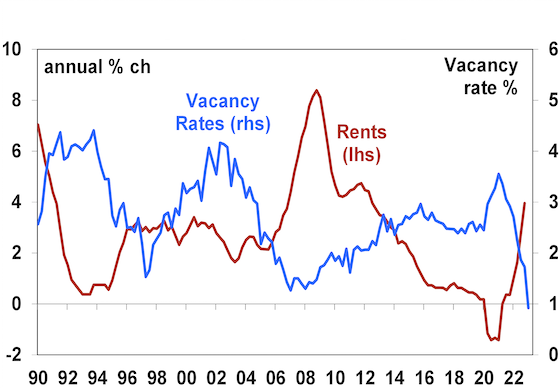

The clearest evidence of the housing shortage is in the rental market. Annual rental growth is up by 4% according to the consumer price data and around 11% if you look at newly advertised leases. The national vacancy rate is at 0.9 %, its lowest on record (see the chart below). High rental growth will weigh on lower income households, as this group has a higher share of renters and will continue adding to inflation as rents make up a solid 6.2% of the consumer price index basket.

Housing vacancy rates and rental growth

Source: ABS, Macrobond, AMP

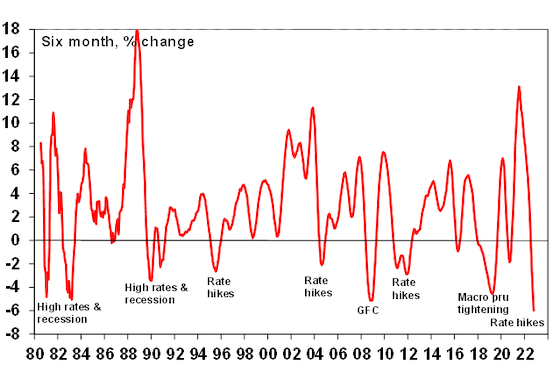

Home prices are driven by many factors including housing demand and supply dynamics but also the cost of land, interest rates which impact borrowing capacity and serviceability and macroprudential policy. National home prices fell by 9.1% from April 2022 to February 2023 (a record decline – see the chart below) but have since risen by just over 1%. The housing shortage is playing a role in stabilising home prices. Expectations that the Reserve Bank is close to the end of its rate hiking cycle also appears to be leading households to expect a rebound in prices which is causing some “FOMO” in the market.

National home prices have seen their fatest falls on record

Source: CoreLogic, AMP

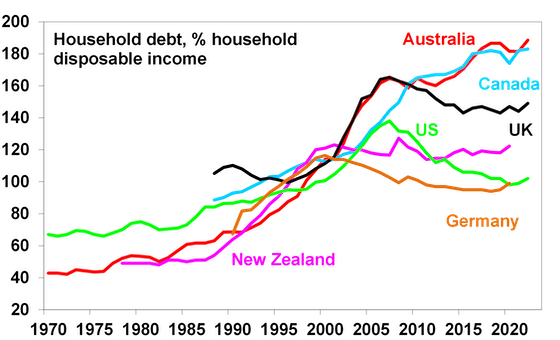

Housing affordability is still a big problem in Australia with the household debt-to-income ratio at a record high at 188.5%, well above our global peers (see the chart below). The decline in home prices in this cycle was negative for household wealth but positive for housing affordability. So, housing shortages will add to long-term affordability issues potentially worsening already high debt levels.

Household debt to income ratios

Source: IMF, RBA, AMP

Can government policies help?

The simple answer to the housing shortage is to build more homes. But the government has a big role to play (especially state governments). Solutions to address housing shortages include lifting the availability of greenfield development, building the right infrastructure (especially transport) outside of the major capital cities to alleviate housing affordability issues which are acute across the major capitals, lowering new approval times and moderating community opposition to new development.

The Federal Government announced a new “National Housing Accord” in 2022 with one of the major initiatives to build 1 million well located new homes over 5 years which averages out at 200K new homes/year with the longer-term aim to build more affordable homes and utilise institutional investment (which is currently low in Australia. However, this is mostly notional, as we should already be building this many new homes per year.

Conclusion

Given the current pace of population growth, Australia’s housing shortage will not improve without a lift in housing construction. Given the current challenges in the construction industry and high interest rates the government has a major role to play in lifting development and building more affordable housing if it wants to maintain its migration targets. For now, the rental market is likely to remain very tight which will keep rental inflation elevated.

Source: AMP April 2023

Important:

This information is provided by AMP Life Limited. It is general information only and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances and the relevant Product Disclosure Statement or Terms and Conditions, available by calling Ph 02 6282 6282, before deciding what’s right for you.

All information in this article is subject to change without notice. Although the information is from sources considered reliable, AMP and our company do not guarantee that it is accurate or complete. You should not rely upon it and should seek professional advice before making any financial decision. Except where liability under any statute cannot be excluded, AMP and our company do not accept any liability for any resulting loss or damage of the reader or any other person. Any links have been provided for information purposes only and will take you to external websites. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.